Last week, Fantex Holdings announced that they had purchased ten percent of the future earnings of five major league baseball players (in addition to four golfers and one football player): Maikel Franco, Jonathan Schoop, Collin McHugh, Yangervis Solarte, and Tyler Duffey. This news didn’t exactly send shockwaves through the baseball world, as most of these players are not yet household names, but it may have sent alarm bells through front offices across the sport.

Fantex has an interesting business model. They pay for the rights to an athlete’s future earnings, and then turn that into stock which any fan or investor can purchase. They were originally planning to list on the NASDAQ, but have pulled that application thanks to these new signings. With the increased portfolio, Fantex wants to optimize their marketing strategy for these stocks. I could probably write a whole essay on Fantex and the concept of buying shares in people, but this is a baseball article, so we’ll keep it to sports for now.

As a general concept, it can make a lot of sense for athletes such as golfers, tennis players, or race car drivers to sell off future earnings, in exchange for money now, as they do not have guaranteed contracts. They are required to win in order to make money. Even football players make some sense, as a large portion of their contracts are also non-guaranteed. But baseball? That’s a new one (well, in legal form anyway). However, it seems to be the next step in what could be a trend of baseball players gaining more financial security without sacrificing much of their future freedom.

It started a couple of years ago when Max Scherzer was heading into his walk year with the Tigers. Coming off a dominant season that captured him the Cy Young Award, Scherzer was offered a six year, $144M contract by Detroit. He turned it down…and rightly so, since he ended up getting much, much more. The news annoyed the Tigers’ brass, who essentially called out their star pitcher for being greedy, but Scherzer had clearly decided to bet on himself rather than take what was clearly a below market offer. However, he also needed to mitigate the ever present risk of injury, so he and agent Scott Boras took out an insurance policy against his potential future contract. If he suffered any kind of injury that prevented him from receiving an offer equal to the Tigers’ initial offer, he would be paid $40M, tax free. Therefore regardless of what happened Scherzer was set for life. That freedom allowed him to bet on himself, and he definitely won.

Now, not everybody can make a deal like that. Max Scherzer was an established star who had a very clear earning potential and was approaching free agency. This is what makes Fantex so interesting. It started with Andrew Heaney selling off future earnings last September, and has continued with the group listed above. What do all those players have in common? They’re talented, but not stars (yet), and they’re each in the pre-arbitration salary portion of their career. In fact, Heaney, Franco, and Duffey have yet to even accrue a full year of service in the major leagues.

Now what does the following group of players have in common?

Evan Longoria, Chris Sale, Paul Goldschmidt, Matt Moore, Kolten Wong, Madison Bumgarner, Jose Quintana, Jedd Gyorko, and Julio Teheran, Jonathan Singleton, and Gregory Polanco.

Each of them signed a contract extension that bought out free agent years while they were talented, but not yet stars, and were in the pre-arbitration salary structure. It is easy to see why these players listed above agreed to contracts that are likely limiting their future earnings. This is the bracket of players who have the biggest financial risk due to low base salaries. You can say all you want about the ‘risk’ associated with a $500,000 USD contract, but the simple fact is that these players have not yet made their ‘set for life’ money. It’s just hard to say no to more than $30,000,000 dollars when you’re making 1/60th of that.

These contracts do hurt these players though, as they are almost universally team-friendly if the player pans out even close to as hoped. Sale, Goldschmidt, Longoria, Bumgarner, and Quintana have already left a ton of money on the table, and Teheran, Quintana, Wong, and Polanco could soon be joining them. In fact, only Gyorko (who is no longer a regular player), and Singleton (who has not yet made the major leagues) seem likely to either break even or make extra money in the long run.

This brings us back to Fantex. With the ability to sell off future earnings, these players suddenly have the option to gain some financial freedom. They can make their “set for life” money without having to give away their freedom of mobility. As a result, there is no need to rush into a long term contract before they have a real handle on how good they are, and how much money they are going to be worth. The players can establish themselves as big leaguers before determining their future.

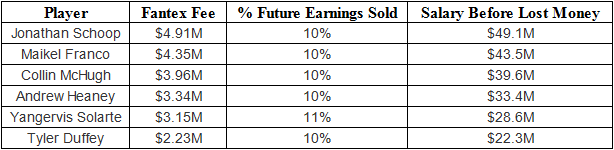

Sure, the Fantex players can lose out on some future salary, but at a measly 10 percent of their future salaries, look how much money they can earn before risking a penny:

Think about how much money some of the people from the earlier list have left on the table by not being able to capitalize on arbitration or their pending free agency. Even if every one of the six Fantex players becomes a high-paid superstar (with the possible exception of Duffey, who is arguably the least likely to reach stardom), who do you think loses out more in the long run? It seems pretty clear that it’s the extension players.

It will be very interesting to see how this all plays out. Some players will still sign contracts, and others will simply play it out through free agency. However, with teams like the Astros using contract extensions as playing time leverage, I would not be at all shocked to see more and more players fight back by taking control of their finances through the Fantex route. This would mean fewer cheap, long-term contracts and more free agency. The owners and GMs would then have to adjust back, trying to save money in other ways.

The business side of baseball is always at its most intriguing when someone changes the rules. Once upon a time it was Marvin Miller and free agency, then it was collusion, and most recently, service time manipulation and draft pick compensation. Now we have Fantex.

I can’t wait to see what comes next.

Lead Photo: Jayne Kamin-Oncea-USA TODAY Sports

One possible consideration not mentioned is the amount of signing bonus money players got. It would seem that those who received millions would be less inclined either to sign a team-friendly extension or to go the Fantex route.

That’s a very worthy point, though many of those players get that signing bonus 3-5 years before making any real money. So with the exception of the top dozen or so picks, it probably doesn’t go quite as far. That being said it definitely does factor into the calculation.

Fwiw, the last supplemental 1st round pick this year, #41 overall, has a slot value of $1.576MM, enough that quite a few people would consider it life-changing. There are 64 slots over the $1MM level, and this number doesn’t include international signings.

That said, I can definitely see the appeal in doing a Fantex deal or in signing an extension in order to guarantee oneself a lot more money.

Very interesting article Josh. I can offer some historical context, as extended periods of easy financial conditions have often concluded with this kind of “deal” emerging for the arts/sports etc. For example, David Bowie’s catalogue pioneered the “Celebrity Bond” in 1997 when he was able to borrow $55 million against future royalty streams. Obviously, that mania went on for 2+ more years until financial conditions changed. Wall Street is incredibly creative and increasingly so as cycles age, and this yet another example. Let’s wait and see through a full market cycle, when credit markets implode and access to capital becomes very limited, and then we’ll see if this is a fad or something sustainable! Regardless – great topic for an article and very well covered, in my opinion.

Thanks for the insight! It’s always interesting to see how things like this have played out in other forms.