In an article last month arguing that the Blue Jays shouldn’t trade Josh Donaldson, Jonah Keri leaned heavily on a financial argument:

“Losing games would be one thing. Losing games and trading Donaldson could signal to fans that a full teardown is underway, and that the next several years of Blue Jays baseball might be tough to watch…Keeping Donaldson around for as long as possible could help prolong the franchise’s off-field momentum, the kind that’s supercharged attendance and TV ratings, and more intangibly made the Jays a hot topic of conversation on those glorious Toronto summer patio nights — like they were 25 years ago.”

Keri here is making a guess about something we don’t really know much about – namely, fan reactions to head office moves, and the implications for franchise revenue. It’s not that the financial side doesn’t matter – in fact, especially for a corporate club like the Jays, it’s crucial! It’s just that we tend to attach too much credibility to our gut instincts when we don’t have facts to lean on. I doubt Keri, or anyone else, wants to be like that scout in Moneyball talking about “the good face.” But when it comes to the economics of baseball, that’s who we often are.

The revolution in baseball analysis hasn’t extended to the financial side, despite its large influence on team decision-making. Even high-effort attempts to understand teams’ current state and future prospects limit their financial analysis to current payroll levels, such as this otherwise very cool concept at the Hardball Times.[1] But to a large extent, current payroll is a backward-looking metric, as it reflects decisions made in the past in potentially different circumstances. For example, the Detroit Tigers are an aging team with a high payroll and a collapsing attendance base. Current payroll may be an indicator of what they’re willing to spend in a good situation, but may not be a good indicator of their willingness or ability to add quality players over the next few years.

Since we currently often use hunch-based economics to support our arguments about what each team should do at the trade deadline, it might be useful to have some analytical tools or theories based on research. For example, what’s the actual “signalling” impact of trading someone like Josh Donaldson or Roberto Osuna? Does attendance reflect who the players are, and how long they’ve been with the team, or is it just about winning? How much does team revenue influence the player budget, and how does that differ based on the type of team owner?

While these questions would require some pretty painful historical research, we probably have enough available data today to create some useful metrics. The rise of Stubhub has produced accessible data about demand for tickets that scalpers never published. This data can be like the “peripherals” of revenue, using current market sentiment to predict a team’s season attendance, which is a good proxy for their revenue.[2] This is exactly the same way xFIP tries to predict long-term ERA. Call it xREV, or xATT.

I think it would be pretty cool if Jonah Keri could say that the xREV for the Blue Jays is looking down about 10% for 2017, so we can’t expect the player budget to increase and need to think about things like trading Roberto Osuna. When Andrew Stoeten says “unless something with their budget changes dramatically, the Blue Jays…aren’t quite going to be in that 2015-like push-in-all-your-chips, our-window-is-right-now kind of place,” this reasonable argument would be helped if xATT showed little reason to expect a dramatic change in their budget.

While we don’t have this metric, I’m going to make a lazy attempt at something similar.

First, let’s look at actual attendance so far this year compared to the last few years:

| Blue Jays Attendance through 36 Home Games | |||

| Year | Record | Total Attendance | Average Per Game |

| 2014 | 39-27 | 914,601 | 25,405 |

| 2015 | 37-33 | 949,648 | 26,379 |

| 2016 | 40-34 | 1,369,090 | 38,030 |

| 2017 | 33-35 | 1,400,638 | 38,907 |

Well, that doesn’t look too bad. On the face of it, the Blue Jays seem to be holding on to the gains they made last year, where they finished the year with 3.3 million fans. As Jonah points out, first in the AL!

But the underlying demand that would go into a predictive “xREV” paint a different picture. To look at it, I used seatgeek.com and my friend Dan. Seatgeek.com has a cool tool that shows you average ticket price on the secondary market for a team over time. My friend Dan lives in Calgary and actively sells every one of his season tickets on stubhub, which he has so he can get playoff tickets.[3] He’s better than your friend Dan because he also keeps really good track of his sales stats.

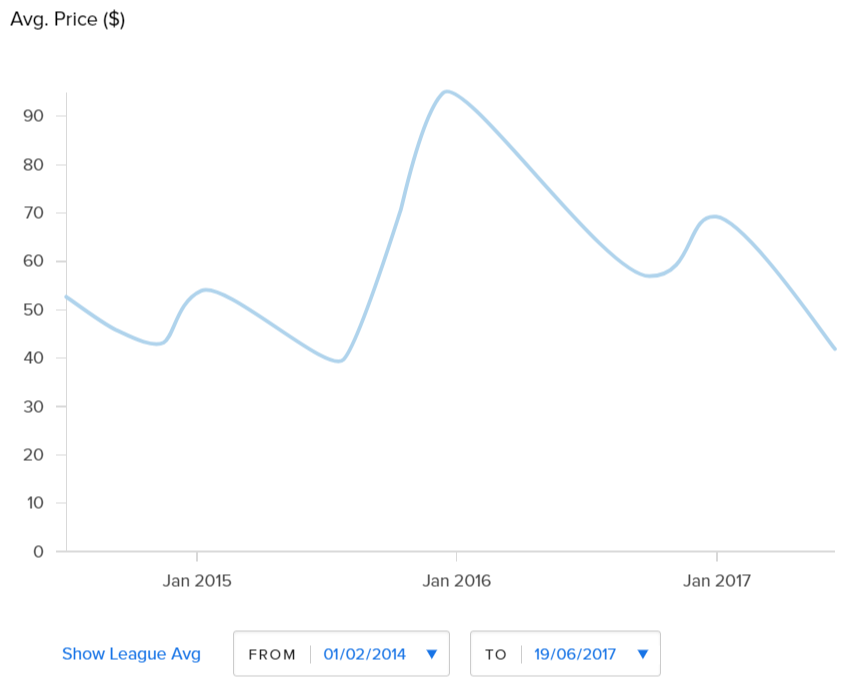

Here’s the Jays picture on seatgeek.com since Feb, 2014:

Average ticket prices last year dipped as low as $57, but this year they’ve barely ever been at that level, and are currently at $42, similar to prices in 2014 and early 2015 when attendance and interest was much lower. They did sell a lot more advance seats this year, so some of this would be expected as there’s a lot more supply in the market, but this should be a good indicator of a reduced interest in walk-up tickets.

Obviously, the team is doing worse, so that’s to be expected, but there have also been times this year where their record was very similar to last year, and it’s the same story.

For example, this year the Yankees came to town for a weekend series June 2-4, with the Blue Jays just under .500. The series drew 138K fans. Last year, the Red Sox came for a weekend series May 27-29 with the team just under .500, and drew 142K fans. That was almost exactly the same situation. According to Seatgeek, last year the average ticket price for the Red Sox series ranged from $45 to $58, while this year it was $39-41 for the Yanks. Dan’s results were even worse, averaging $61 a ticket this year versus $91 last year. Even when the team performance was equally bad, demand this year is a lot less than last year.

In fact, so far this year Dan’s getting crushed.[4] Here’s his stats through 36 games:

| Dan’s Ticket Sales (through 36 games) | ||||

| Total Sales | Average | Sales above $90 | No Sale | |

| 2016 | $2,242 | $62.29 | 12 | 3 |

| 2017 | $1,228 | $34.11 | 1 | 10 |

And if you think he’s being lazy, he’s actually working harder this year. “Last year I held back the tickets because we knew there’d be real demand for the big games. This year, I have to post them way in advance, actively manage the change in prices and keep adjusting. I’m not going to do it again next year.” So, the Jays are already down two seats in 2018!

The change showed up very early, as last year’s home opener average on seatgeek was $61, while this year’s, after the miserable 1-5 start, was $39. Dan’s story was worse again, selling last year’s tickets for $260, and this year’s for $67.[5]

If demand continues to be this soft for new ticket sales, you’d expect to see a much lower average attendance for the rest of this year than the 47K per game they had from this point forward in 2016. Even keeping our league-leading current average attendance of 39K per game leads to a loss of 350K fans for the year. And there’s some evidence (the Yankees/Red Sox series comparison) that even if the team rallies back to take a wild card, interest would be lower than it was for the same result last year. If I had to take a stab at xATT, it would be 2.9-3.1M.

In Keri’s perfectly reasonable article about trading Roberto Osuna,[6] he says this about the Jays fanbase: “Balanced against all that is a fanbase that’s been energized by the team’s recent success, with two straight ALCS appearances producing the best home attendance for any American League team this year, as well as surging TV ratings and a more intangible buzz around the ballclub, the kind that hadn’t been felt since the back-to-black glory years of 1992 and 1993.”

We’ll see how the rest of the season goes, but it’s possible that momentum has already swung the other way, and that underlying attendance “peripherals” may point to a lot less money to work with going forward. Before we trade Donaldson and “tear it all down,” this is pretty lazy analysis, and could easily be useless. But there’s a big gap in the baseball analytics world, and developing some useful tools on these topics would make predicting a team’s moves a lot more interesting and better informed.

Lead Photo © John E. Sokolowski-USA TODAY Sports

FOOTNOTES

[1]The analysis attempts to find a historical match for each current team based on a number of dimensions. The Jays are, as it happens, compared to the 1990 San Francisco Giants, who won 85, 75 and 72 games from 1990-1992. Let’s hope not!

[2]Attendance is a team’s primary revenue source, and you’d expect it to drive merchandise sales, which are two of the three main drivers of revenue. TV is the other, and for most other teams, this is a long-term contract unaffected by attendance. Because the Blue Jays don’t have a TV contract for a specific set amount of money, TV revenue for the Blue Jays/Rogers is directly tied to advertising revenue, which is directly tied to ratings and therefore fan interest. So, attendance is a better proxy for revenue for the Jays than other teams.

[3]This worked out really well for Dan last year, as he made enough of a profit on the regular season seats to more or less pay for his trip to Toronto to see the playoffs. This year, not so much.

[4]Before you scream “small sample size,” Stubhub works largely like a stock market for tickets, where there are many buyer and sellers, so an active seller’s result will be indicative of the actual market rate.

[5]To be fair, last year was a Friday against the Red Sox and this year was a Tuesday against the Brewers, but these are some pretty dramatic differences.

[6]Not to get too deeply into this, but Osuna’s going to cost somewhere between $25-30M in his last three years of arbitration eligibility if he stays healthy. Kenley Jansen signed for $16M/year, or about $50M over the same time period. The recent hauls for players like Ken Giles and Tyler Thornburg were worth more than the difference, and Osuna’s better than those guys (not to mention the Andrew Miller and Craig Kimbrel deals). I’m not saying “do it,” but it’s certainly not crazy. And my love for Osuna runs deep…

Using secondary ticket market analysis is not obviously the only indicator of revenue trending. Although tickets are the primary source of revenue, media & corporate sponsorship & merchandise are also major contributors.

The ‘pre’ revenue factors truly determine the business decisions a club makes, not the in-season revenue mix alone.

If the Jays decided to make wholesale changes which would move major ‘stars’ off the team, imagine the impact on merchandise sales?

My view is that ticket sales dictate fan interest, and everything follows from that. It was true as viewership followed attendance up, in a similar ratio, in 2015. Corporate sponsorship is a very small percentage, and merchandise will follow interest.

I’d also argue that in-season revenue in 2017 absolutely will influence decision made in 2017 about the 2018 budget.

When you say “imagine the impact on merchandise sales” this is what I’m talking about in this article. Not only are merchandise sales a small percentage of revenue, we don’t know anything about how it’s affected by a major star leaving. We can only guess. I get that your guess makes intuitive sense, but may also be wrong. If Donaldson leaves, will we sell more Osuna stuff instead? We could logically argue this for a while, but neither of us have any actual facts.

This Article was the definition of cherry picking data. It paints a picture that does not answer any of the questions stemming from the title of the article.

1. What was Dan’s face value? if he was making a considerable mark up would this not be something to identify.

2.A. Jays as a franchise make money on ticket sales, not after market.

2.B. This also takes attendance rather than sales. Your friend dale has been responsible for this shortfall by 20 seats.

I get some of this information isn’t at your disposal, but if you have to piece together an article to meet a forced topic, maybe another should be chosen.

Dan’s face value was $61. I’m not sure how it’s relevant, but hopefully that helps you. I don’t actually know what you mean in 2B.

I don’t actually know what you mean in 2B.

Yes, the Jays make money on ticket sales. But if you don’t believe that the demand for buying tickets for tomorrow’s game from the box office is influenced by the demand for the secondary market for the same tickets, than you won’t believe this metric. But, I’m pretty sure those demands would be the same. If the secondary market price is below face value (where it’s often been this year) don’t you think that will lower demand for tickets at the gate?

And it’s Dan, not Dale.

If we don’t force topics on this stuff we’ll never find any metrics to use. I definitely disagree with you if you think the secondary market for tickets has no relevance to the Blue Jays ticket revenue or the level of fan interest. But hopefully debates like this will lead to better information!

Also – the point was to nail the analysis, but to talk about how this type of research could be useful.

Reflecting on a couple of twitter comments: I think something I missed (and Des may have been referring to) is that the real impact is when secondary tickets rise above or below face value. If it’s above, box office seats will be a better deal, so the Jays will sell more tickets until they sell out or run out of the seats people want. If it’s below, you’d expect most people to use stubhub and not buy from the team. For what it’s worth, the vast majority of Dan’s seats have sold below face this year, and it was about 50/50 to this point last year. Lots more work to do to develop these usefully!

One of the overlooked reasons in this article is that brokers have about 20% more tickets then they did last year which has been the biggest reasons of the drop in value on the secondary market. More supply=less $

”

The change showed up very early, as last year’s home opener average on seatgeek was $61, while this year’s, after the miserable 1-5 start, was $39″

I don’t agree. Look at:

http://news.sportslogos.net/2017/04/11/mlb-unveils-2017-holiday-uniforms-will-now-cover-entire-weekends/

Best regards, Arianne